NJ L-4 2008 free printable template

Show details

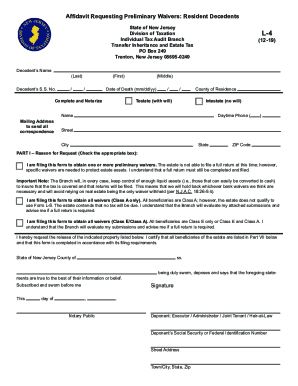

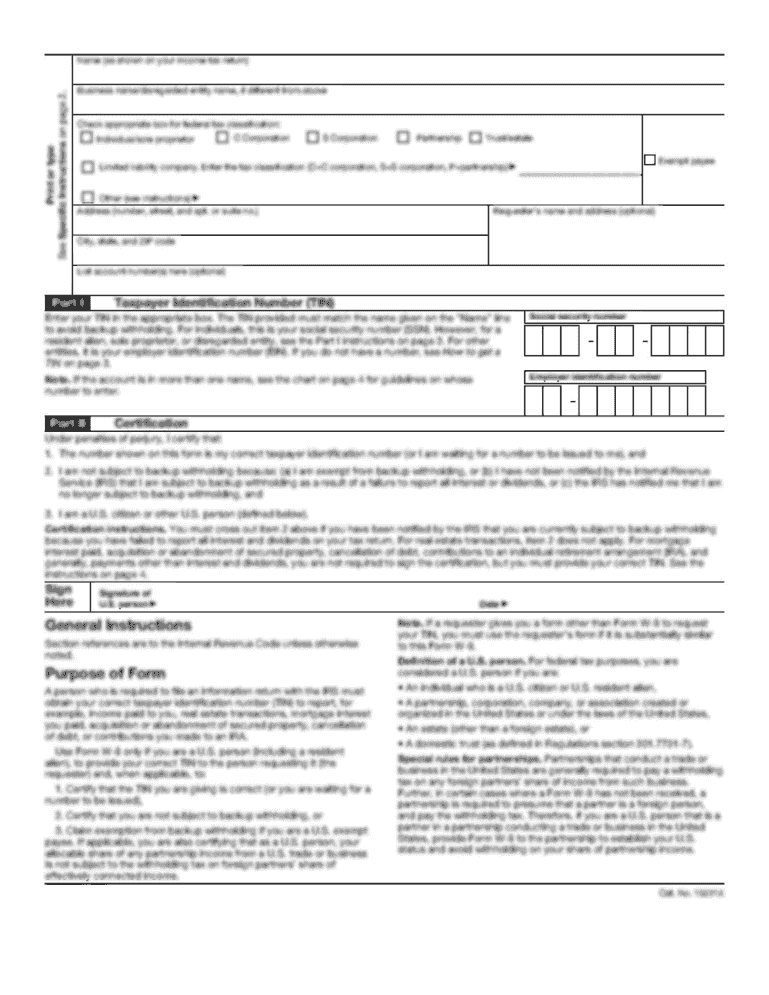

(Resident-Decedent) Form L-4 (7-08) (Form of preliminary report to secure consents to transfer where final return cannot be presently completed) STATE OF NEW JERSEY DEPARTMENT OF THE TREASURY DIVISION

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your nj inheritance waiver tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nj inheritance waiver tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nj inheritance waiver tax form 01 pdf online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit new jersey inheritance tax waiver form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller.

NJ L-4 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nj inheritance waiver tax

How to fill out nj inheritance waiver tax:

01

Obtain the necessary forms from the New Jersey Division of Taxation or their website.

02

Fill out the personal information section including your full name, address, and social security number.

03

Provide details about the deceased individual including their name, date of death, and relationship to you.

04

List the assets included in the inheritance and their estimated value.

05

Calculate the tax owed on the inheritance using the appropriate tax rates and deductions.

06

Fill out any additional sections or questions required by the form.

07

Review the completed form for accuracy and completeness.

08

Sign the form and date it.

09

Submit the filled-out form along with any required supporting documents and payment to the New Jersey Division of Taxation.

Who needs nj inheritance waiver tax:

01

Individuals who are inheriting property or assets in the state of New Jersey.

02

Executors or administrators of estates who are responsible for filing the necessary tax forms.

03

Anyone who wants to waive their rights to inherit a particular property or asset.

Fill nj 01 form : Try Risk Free

People Also Ask about nj inheritance waiver tax form 01 pdf

Do beneficiaries have to pay taxes on inheritance in NJ?

Who files NJ Inheritance Tax return?

How do I disclaim an inheritance in NJ?

Do you have to pay taxes on inheritance money in NJ?

How do I get a NJ Inheritance Tax waiver?

Do I have to file a NJ inheritance tax return?

What is NJ Inheritance Tax waiver form O 1?

Does New Jersey require an inheritance tax waiver form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How to fill out nj inheritance waiver tax?

To fill out the New Jersey Inheritance Tax Waiver, you will need to provide certain information such as the deceased person's name, address and Social Security number. You will also need to provide the name and address of the executor or administrator of the estate, as well as the name and address of the beneficiary or beneficiaries. Other information required includes the date of death, the estate's assets, and the name of the county in which the property is located. Once you have completed the form, you must sign and date it, and submit it to the New Jersey Division of Taxation.

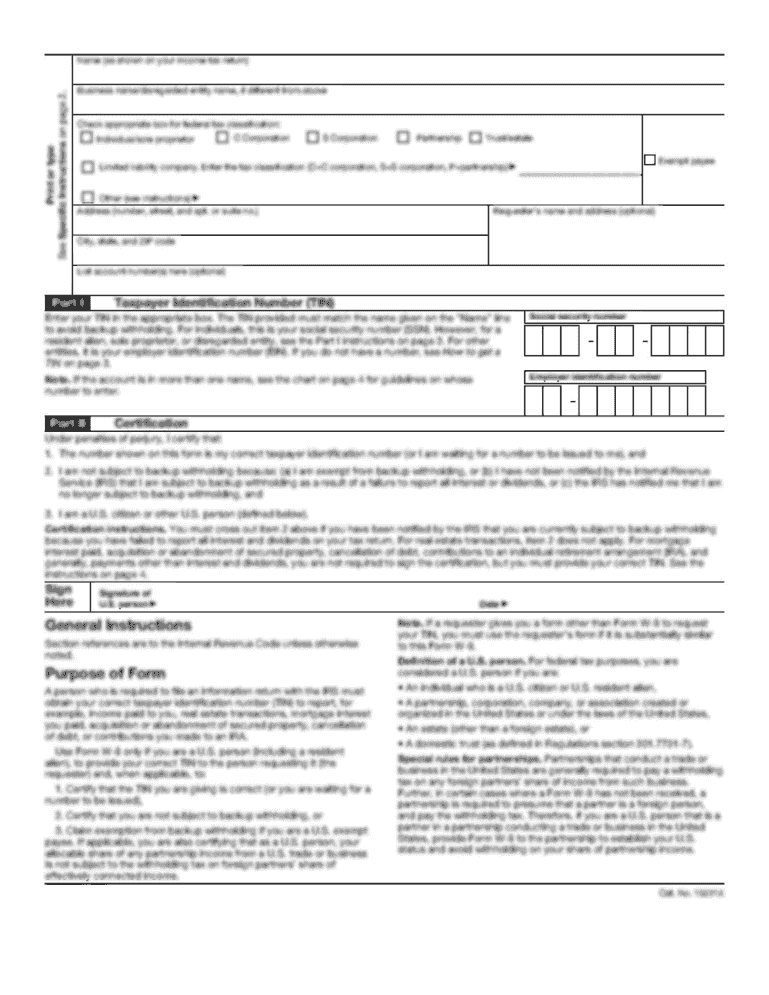

What information must be reported on nj inheritance waiver tax?

The NJ Inheritance Tax Waiver must include the following information:

1. The names of the decedent and the heirs

2. The date of death of the decedent

3. The residence of the decedent

4. The relationship between the decedent and the heirs

5. The value of the assets passing to the heirs

6. The names of any trustees or executors of the estate

7. A description of any debts or liens against the estate

8. A description of any transfers to charity

9. The amount of any inheritance tax due and the method of payment.

When is the deadline to file nj inheritance waiver tax in 2023?

The deadline to file NJ inheritance waiver tax in 2023 is April 15, 2023.

What is nj inheritance waiver tax?

NJ inheritance waiver tax refers to a tax imposed on inheritances received in the state of New Jersey when an individual chooses to waive their right to the inheritance. In certain cases, beneficiaries may opt to renounce or disclaim their inheritance for various reasons, such as to avoid tax liabilities or to redirect the assets to other beneficiaries. However, New Jersey imposes a tax, known as the Inheritance Tax, on inheritances received by certain beneficiaries, including non-class A beneficiaries (such as siblings, nieces, nephews, etc.), regardless of whether the beneficiary accepts or waives the inheritance. Therefore, even if a beneficiary chooses to waive their right to the inheritance, they may still be subject to the NJ Inheritance Tax based on their relationship to the deceased. It is important to consult with a tax professional or an estate planning attorney for specific guidance on inheritance tax laws and regulations in New Jersey.

Who is required to file nj inheritance waiver tax?

In New Jersey, the inheritance waiver tax is required to be filed by the beneficiary of an inheritance if they meet certain criteria. The filing requirement applies if the beneficiary is in a Class A beneficiary category, which includes parents, children, stepchildren, grandchildren, and other close relatives. However, it is advisable to consult with a tax professional or attorney for specific guidance based on individual circumstances.

What is the purpose of nj inheritance waiver tax?

The purpose of the New Jersey inheritance waiver tax is to generate revenue for the state by imposing a tax on the transfer of wealth from a decedent to a beneficiary who has waived their right to inherit. This tax is intended to ensure that the state receives financial compensation for the transfer of wealth, even if the beneficiary has voluntarily given up their inheritance. The exact rules and rates of the inheritance waiver tax can vary, so it is recommended to consult with a legal or tax professional for specific information based on individual circumstances.

What is the penalty for the late filing of nj inheritance waiver tax?

The penalty for late filing of an NJ inheritance waiver tax is calculated as a percentage of the tax due for each month (or part of a month) that the return is late. The penalty rate is 5% per month, with a maximum penalty of 25% of the total tax due. Additionally, interest may also be assessed on the unpaid tax amount. It is important to note that the specific penalty and interest amounts can vary, so it is recommended to consult with a tax professional or refer to official New Jersey tax resources for the most accurate and up-to-date information.

How do I edit nj inheritance waiver tax form 01 pdf online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your new jersey inheritance tax waiver form to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit nj inheritance tax waiver on an Android device?

With the pdfFiller Android app, you can edit, sign, and share nj inheritance tax waiver form on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

How do I fill out inheritance tax waiver nj on an Android device?

Complete your nj tax waiver form and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your nj inheritance waiver tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nj Inheritance Tax Waiver is not the form you're looking for?Search for another form here.

Keywords relevant to new jersey tax waiver form

Related to tax waiver form nj

If you believe that this page should be taken down, please follow our DMCA take down process

here

.