NJ L-4 2019-2026 free printable template

Show details

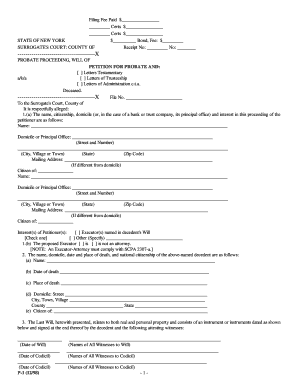

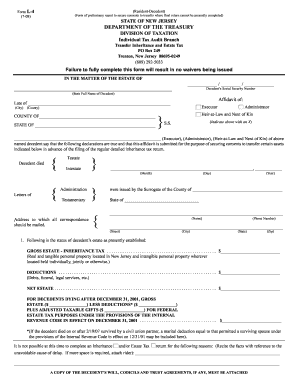

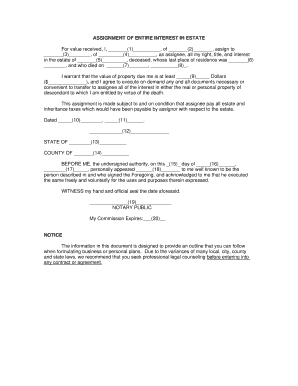

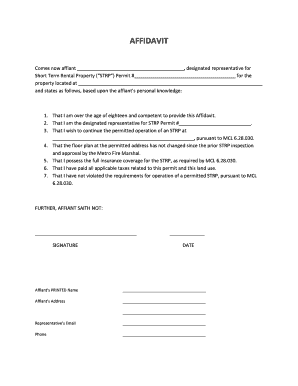

Affidavit Requesting Preliminary Waivers: Resident DecedentsL4(1219)This form may be used when: A complete Inheritance or Estate Tax return cannot be completed yet; or All beneficiaries are Class

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign nj inheritance waiver tax form 01 pdf

Edit your nj tax waiver form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your inheritance tax waiver form nj form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit o 1 form online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax waiver form nj. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ L-4 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form l 4

How to fill out NJ L-4

01

Obtain Form NJ L-4 from the New Jersey Division of Taxation website or your employer.

02

Fill in your personal information in the designated sections, including your name, address, and Social Security number.

03

Indicate your filing status by checking the appropriate box (Single, Married, etc.).

04

Provide information about your allowances. Calculate the number of allowances using the worksheet provided with the form.

05

If applicable, specify any additional amounts you want withheld from your paycheck.

06

Sign and date the form to confirm the information is accurate.

07

Submit the completed NJ L-4 form to your employer, not the state.

Who needs NJ L-4?

01

Employees working in New Jersey who need to adjust their state tax withholding.

02

Individuals who prefer to update their tax withholding in response to life changes (marriage, divorce, dependents).

03

New employees starting work in New Jersey who need to provide their tax withholding preferences.

Fill

nj inheritance waiver tax form 01 pdf online

: Try Risk Free

People Also Ask about l 4 form nj

Do beneficiaries have to pay taxes on inheritance in NJ?

New Jersey has had an Inheritance Tax since 1892, when a tax was imposed on property transferred from a deceased person to a beneficiary. Inheritance Tax is based on who specifically will receive or has received a decedent's assets, and how much each beneficiary is entitled to receive.

Who files NJ Inheritance Tax return?

The executor, administrator, or heir-at-law of the estate must file an Inheritance Tax return (if required) within eight (8) months of the date of the decedent's death.

How do I disclaim an inheritance in NJ?

The disclaimer must be in writing, signed and acknowledged by the disclaimant (yourself), it must describe the property disclaimed and it must declare the disclaimer, and must specify the extent of the disclaimer.

Do you have to pay taxes on inheritance money in NJ?

New Jersey has had an Inheritance Tax since 1892, when a tax was imposed on property transferred from a deceased person to a beneficiary. Inheritance Tax is based on who specifically will receive or has received a decedent's assets, and how much each beneficiary is entitled to receive.

How do I get a NJ Inheritance Tax waiver?

Waivers (Form 0-1) can only be issued by the Inheritance Tax Branch of the NJ Division of Taxation. It is not a form you can obtain online or fill out yourself. In most circumstances, some kind of return or form must be filed with the Division in order to have a waiver issued.

Do I have to file a NJ inheritance tax return?

The executor, administrator, or heir-at-law of the estate must file an Inheritance Tax return (if required) within eight (8) months of the date of the decedent's death.

What is NJ Inheritance Tax waiver form O 1?

Form 0-1 is a “waiver" that represents the written consent of the Director of the Division of Taxation to transfer or release certain property in the name of a decedent. New Jersey property (such as real estate located in NJ, NJ bank and brokerage accounts, stocks of companies incorporated in NJ, and NJ bonds, etc.)

Does New Jersey require an inheritance tax waiver form?

The New Jersey Inheritance Tax and Estate Tax statutes do not allow property owned by, or in the name of, a resident decedent to be transferred without written consent – in the form of a tax waiver – from the Director of the Division of Taxation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form o 1 in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing nj inheritance tax waiver form 0 1 and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I sign the new jersey inheritance tax waiver form electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your nj 01 form in seconds.

How do I complete new jersey inheritance tax waiver on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your o1 form. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is NJ L-4?

NJ L-4 is a New Jersey Employee's Withholding Allowance Certificate used to determine the amount of state income tax withholding from an employee's paycheck.

Who is required to file NJ L-4?

All New Jersey employees who wish to claim withholding allowances for state income tax purposes are required to file NJ L-4 with their employer.

How to fill out NJ L-4?

To fill out NJ L-4, an employee must provide their name, address, social security number, number of withholding allowances they are claiming, and any additional amount they wish to withhold.

What is the purpose of NJ L-4?

The purpose of NJ L-4 is to inform employers how much state income tax to withhold from an employee's paycheck based on the number of allowances claimed.

What information must be reported on NJ L-4?

The information that must be reported on NJ L-4 includes the employee's personal details, their chosen withholding allowances, any additional withholding requests, and signature.

Fill out your NJ L-4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Jersey Tax Waiver Form is not the form you're looking for?Search for another form here.

Keywords relevant to nj 01 form pdf

Related to nj l4

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.